The CFO’s Guide to xP&A: Moving Beyond Traditional Budgeting

This is the time of the year most personnel fear: the start of the budget process. Fresh back from the holiday season, getting back to the office and finding a full Inbox. And the first task to provide input for is the new next year’s budget. In most organisations this is a labour intense exercise with a predictable outcome: no one recognises the final and approved budget due to the many iterations and last-minute changes from management. As a result, no one feels responsible for the numbers, resulting in constant adjustments to get back on track.

The exercise is mandated by management and under the supervision of Finance. Every department is asked to input the numbers (probably many Excel files and versions of these files), but alignment across departments (horizontal) is nonexistent only top-down versus bottom-up (vertical). This siloed, once-a-year approach is destined to fail.

One of the options to overcome this inefficient process is to introduce rolling forecasts and budgeting. Another option is to facilitate the alignment between departments (horizontal) as well as the top-down versus bottom-up (vertical) alignment.

Traditional budgeting is dead

Traditional budgeting should be a beast of the past. With the current knowledge, expertise, and tooling, let’s dive into an aligned, transparent, and fast way of budgeting.

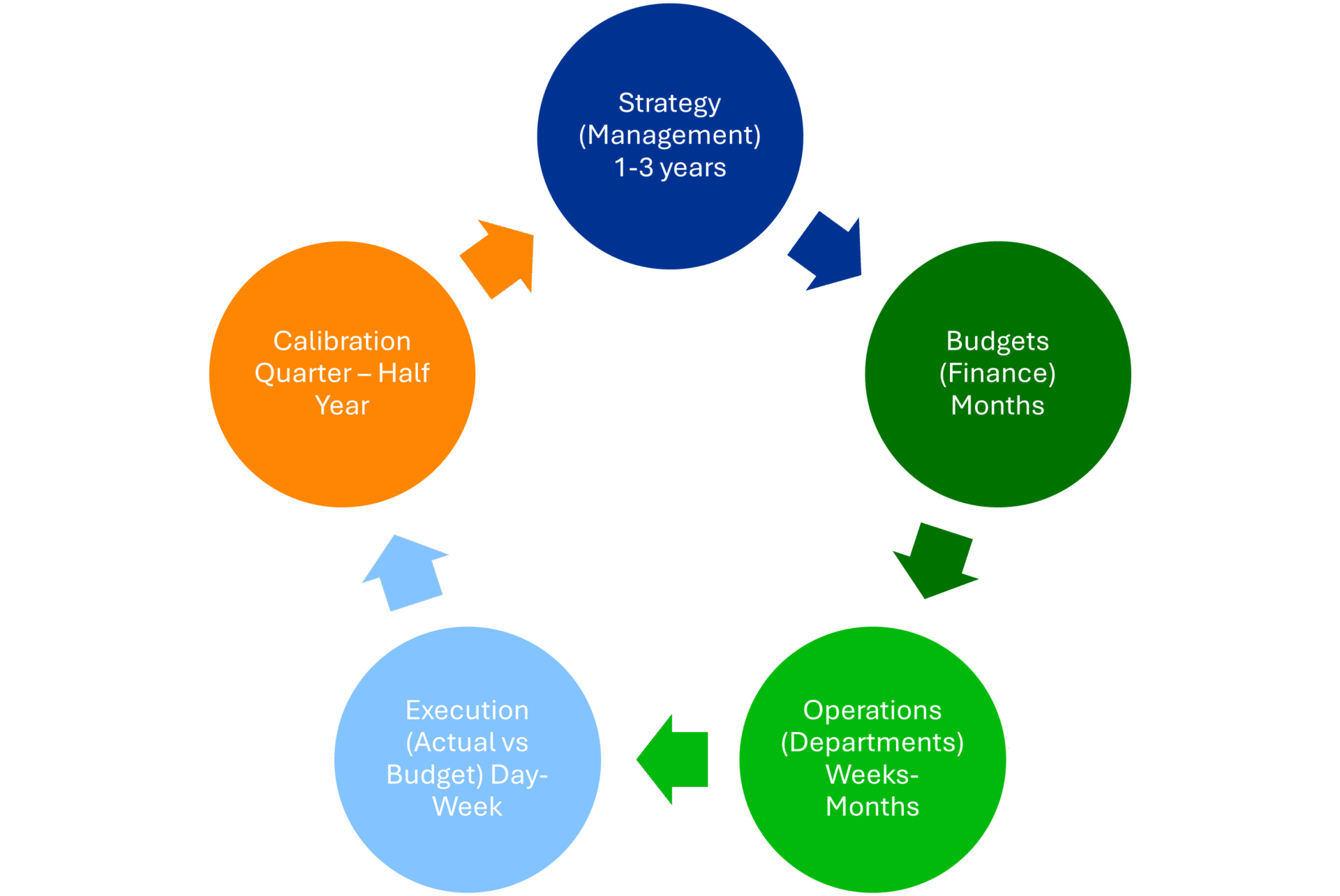

Strategy

Management checks, defines, and redefines the strategic goal of the organisation every 3 years. This cycle could be shorter or longer, based on the predictability of your business. Management sets the goals and direction for the future years of the company. This direction entails different components, like products, customer segments, innovations, services, personnel, and tools. The strategy is high-level, but detailed enough for people to get an understanding of the direction.

Budgets

Finance translates the strategy into financial plans (budgets) for the coming years. Besides expected turnover and operational costs, also investment should be made visible and the impact on the P&L, Balance Sheet, and Cash Flow report.

The financial KPIs of the organisation that are set as Key Performance Indicators (KPIs) should give guidance if all the strategic plans direct the organisation onto the right direction. For example, a large retailer has an ambitious growth strategy, but to support that, new stores and warehouses need to be created. This will come at a cost. Turnover will show growth, but Margin can decline or stay the same due to the investment in new stores and warehouses.

Once the strategic direction has been defined, the corresponding KPIs can be defined and monitored over the years, quarters and months to come to check if the company is on track.

Operations

Once the strategy has been translated into budgets, via the Objectives and Key Results (OKRs) process, the translation can be made to departmental goals and budgets. Each department has its own specifics and impact on the P&L, Balance Sheet, and Cash Flow. The strategic goals are translated into portfolios of projects, and the projects will deliver the required outcomes. By defining a portfolio, a cross-departmental approach is defined to steer the organisation towards the strategic goals.

For example, the department Supply Chain, due to the growth ambition to open new stores, new warehouses need to be opened. This comes with additional costs of locations, staff, software, as well as additional stock build. This will have an impact on the cost side of the P&L, but it supports the strategic direction set by management with the financial guardrails from Finance.

Execution

Once the operational plans are created, it is time to execute. Projects are set up, investments are made in soft & hardware, staff are hired and trained, and the operational running costs all define the operational spending.

Based on this financial spending, the Finance team oversees on a monthly base the budget versus actuals. Deltas will become visible, and with deviations that surpass a threshold, explanations need to be delivered by the departments. Changes can be made, or the current way of working is accepted, so the departments can continue.

This way of working is the much-needed feedback loop and keeps the organisation on track with the strategic direction and goals. Each month, management can check progress and adjust where needed when off track. And these actions will show the results in the months to come.

Calibration

In this final step, management needs to consider the strategic direction. Based on the feedback loop, a monthly reality check is performed to see if the company is still on track. If the company stays aligned with the strategic direction or when small deviations occur, management can adjust the operational actions to stay in line with the strategic intent.

But in this unpredictable and fast-changing world, it might be that the strategic direction set a few months ago has become invalid. In this calibration step, management has the ability to challenge the strategy and might come to the conclusion that, based on changed conditions, the strategy needs to be adjusted. For example, the trade tariffs, the impact on some companies is huge, you need to change course and define new actions to deal with these conditions.

Conclusion: simple, but not easy

As mentioned above, the old way of budgeting is dead. Strategy is translated into financial plans, translated into operational plans and actions, and the feedback loop allows organisations to have a consistent and transparent view of the direction of the organisation. This is not a management responsibility only, or Finance, it is the responsibility of all departments and all employees. By clearly communication top-down as well as bottom-up, having the right data and visibility on progress using (financial) reports to support the feedback loop, an organisation is able to switch course of action when needed, not when it is already too late.

This requires communication, but also the delegation of tasks and responsibilities to the operational level, where decisions can be made fast. With the abundance of data and tooling, this is not difficult to set up. It is even simpler, not easy, but simple to bring your organisation to the next level of maturity and be better able to deal with uncertainty and competition.

If you think this could be an interesting way of working for your organisation and want more details, please reach out to us by email or phone (+31651884701).

Let's Talk!