Integrated Business Planning - Operations

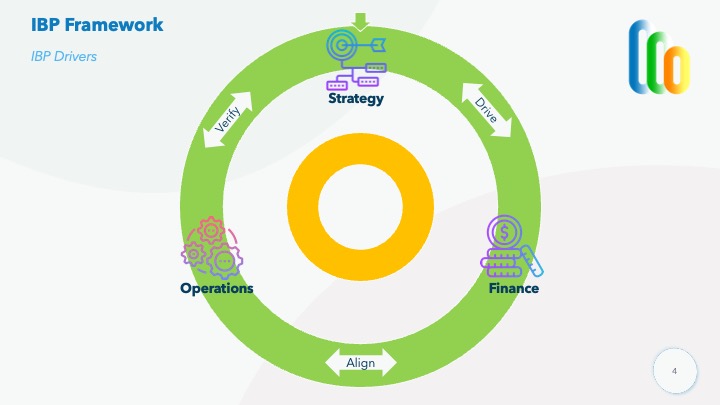

This is blog 4 in a series of 9 on the topic Integrated Business Planning (IBP). In these blogs we will detail our IBP Framework, the importance of a proper IBP implementation and the benefits it can bring organisations. Topic of this blog: Operations.

Introduction

In the last two blogs we described Strategy and Finance. We see in many organisations that these two are closely linked. Strategy is translated into yearly plans and closely monitored for progress. The disconnect in most organisation starts with Operations.

What do we mean with Operations? For this blog series, Operations is any function, activity within an organisation that performs the work to establish the goals of the company. Think of departments like Sales, HR, Supply Chain, Procurement. etc. The disconnect between Operations and Finance and Strategy is causing a lot of issues. Once the strategic intent has been shared and the financial plans are made, most departments do not have the incentive to align their plans and actions with strategy. Operational issues arise, ‘fire fighting’ is a day-to-day activity…this keeps the focus narrow and focused to solve the issues at hand. Which is a normal reaction: Operations want to serve the customer and if there are issues, these issues need to be solved.

The solution is very simple from a theoretical perspective, but very difficult in practice. How do you make sure Operations keep their focus to perform their work at the qualitative level as expected, keep aligned with the strategic direction and stay within the financial boundaries? If you are solving operational issues on a frequent base, the broader view gets lost. How do we make sure the connection between Operations and Finance and Strategy is established and stays connected? We recommend the following steps:

- Align the Operations incentive system with Finance and Strategy.

- Create a short feedback loop from Operations to Finance.

- Communicate the strategic intent on a regular base.

- Align regularly between departments, Finance and C-level.

Align the Operations incentive system with Finance and with Strategy

If the behaviour of the operational departments are incentivised, but the incentives are not aligned with the strategic direction, you will never get the required results. People will put in the extra work to achieve their incentives, especially if these are financial rewards (which is in most cases). Incentives steer the actions of the people on the work floor and therefor needs to be aligned with the strategic direction.

One way to achieve a connected set of incentives from top to bottom is by the use of OKR’s (Objectives and Key Results). This mechanism makes sure that higher level objectives are broken down per department within an organisation and the specific, measurable key results attached to it. Once this pyramid of OKR’s from top (Strategy) to bottom (Operations) has been established and agreed, every action, every decision can be made based on this framework to make sure everyone is aligned to the greater cause.

Create a short feedback loop from Operations to Finance

Once the OKR’s have been established on departmental level, the financial translation can be made. What does that mean for the different cost components, what is the expected amount? What revenue is expected? I have come across organisations where full P&L’s were created and monitored per cost- & profit center in an organisation.

Due to this financial translation, periodic feedback loops can be created with Finance. Where are we lagging behind as a department, for which financial components are we in line with expectations or even ahead? Based on a monthly financial ‘health check’, you have the ability to establish your status quo and see what actions to take to get back in control. What needs to be stopped, what needs to be started?

Communicate the strategic intent on a regular base

The creation of a strategy plan is a one off exercise. This plan is checked on a regular base (are we still on course, do we need to update the strategy after one or two years?). What is often lacking is the reinforcement across all departments within the organisation of the strategic direction. We see a lot of companies where the new or updated strategy is shared once using town hall meetings, departmental meetings, a nice flyer or a PowerPoint slide deck.

This initial sharing is necessary, but needs to be repeated on a regular base. People get back to their work and the strategic intent gets blurry after a few weeks. So a periodic (monthly, quarterly) reinforcement is a necessity. And this could mean that specific parts of the strategy are reiterated, but people need to get back on track once in a while, their focus should be calibrated again on the strategy. This constant reminder and communication is the task of C-level and management. They are the owner of the strategic intent as well as the constant reminder and communication.

Align regularly between departments, Finance and C-level

If all of the above is implemented, make sure that the different stakeholders in your organisation align on a monthly base to check if everyone is working towards the same goal. As mentioned, due to operational focus and operational issues, the focus shifts from strategic to operational level. Every month, everyone should recalibrate and get the latest update from C-level, Finance and the other departments to make sure the strategic goal will be achieved.

Without alignment, departments start to drift off course, resulting in not achieving the goals or only partly. Regular touch points are needed to stay on track and adjust where needed.

In our next blog, we will dive into the fourth part of our IBP journey, Continuous Improvement. This touches on the Plan – Do – Check – Act cycle of Deming to continually improve the processes within your organisation.